Fraud detection is a critical component of financial security, safeguarding businesses and individuals from significant financial losses. Traditional methods of detecting fraudulent activities have become increasingly inadequate in the face of evolving tactics by fraudsters. The integration of Artificial Intelligence (AI) in fraud detection has emerged as a transformative solution, enhancing the ability to identify and prevent fraudulent activities with remarkable precision and efficiency.

The Evolution of Fraud Detection

Traditionally, fraud detection relied heavily on rule-based systems and manual oversight. These methods, while effective to an extent, struggled to keep pace with the sophistication and scale of modern fraudulent schemes. Rule-based systems depend on predefined patterns and scenarios, which fraudsters can easily bypass with new techniques. Manual oversight, on the other hand, is time-consuming and prone to human error.

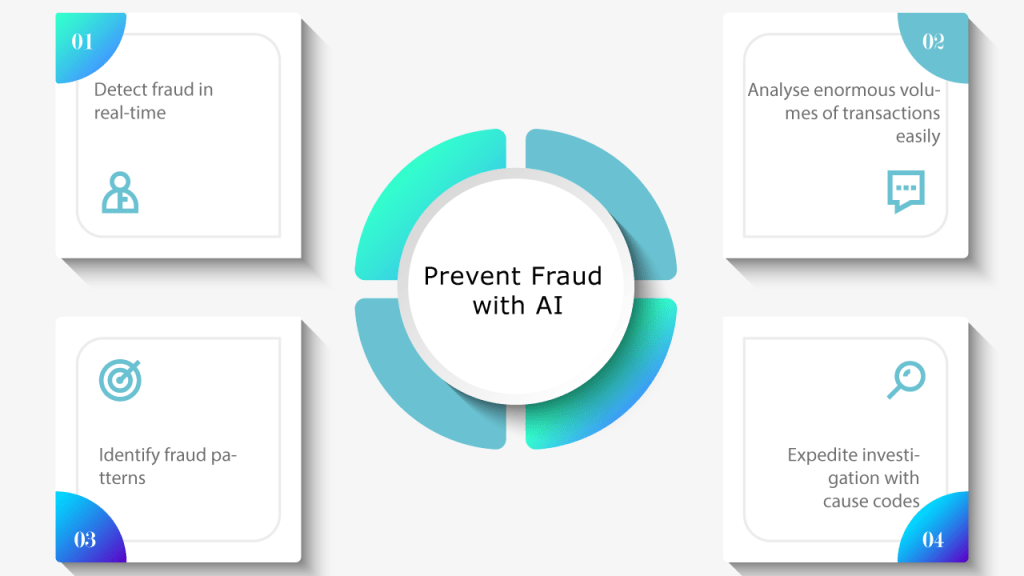

The advent of AI in fraud detection marks a significant advancement, providing dynamic, scalable, and accurate solutions to combat fraud. By leveraging machine learning algorithms, AI systems can analyze vast amounts of data, identify patterns, and detect anomalies that may indicate fraudulent behavior, all in real-time.

How AI Enhances Fraud Detection

- Data Analysis and Pattern Recognition AI systems excel at processing and analyzing large datasets quickly and accurately. Machine learning algorithms can sift through transactional data, customer behavior patterns, and historical fraud data to identify unusual activities. These systems are capable of learning and evolving, improving their detection capabilities over time. Unlike traditional systems, AI can recognize complex patterns that are not immediately obvious, thus identifying fraud attempts that might otherwise go unnoticed.

- Real-Time Detection and Response One of the most significant advantages of AI in fraud detection is its ability to operate in real-time. AI-powered systems can monitor transactions as they occur, flagging suspicious activities instantaneously. This rapid detection allows businesses to respond to potential fraud before it escalates, minimizing financial losses and enhancing security. For example, in the banking sector, AI can instantly freeze an account if unusual activity is detected, preventing further unauthorized transactions.

- Behavioral Analysis AI technologies utilize behavioral analysis to establish baselines of normal activity for individual users. By understanding typical behavior patterns, AI systems can detect deviations that may indicate fraudulent actions. For instance, if a user’s account suddenly exhibits transactions from different geographical locations or unusual spending patterns, the AI system can flag these activities for further investigation. This personalized approach significantly improves the accuracy of fraud detection.

- Advanced Anomaly Detection Anomaly detection is a cornerstone of effective fraud detection. AI excels in identifying anomalies by comparing current data against established patterns. Techniques such as clustering and neural networks enable AI systems to distinguish between legitimate variations in behavior and potential fraud. This capability is particularly useful in detecting complex and subtle fraud schemes that traditional methods might miss.

- Reduction of False Positives Traditional fraud detection systems often generate a high number of false positives, causing unnecessary alarm and operational inefficiencies. AI systems, however, are designed to refine and improve their accuracy continuously. By analyzing vast datasets and learning from previous incidents, AI can reduce the occurrence of false positives, ensuring that alerts are more reliable and actionable. This enhancement not only streamlines operations but also improves customer experience by minimizing disruptions.

Applications of AI in Various Sectors

- Banking and Finance The banking and finance sector is particularly vulnerable to fraud due to the high volume of transactions and the significant value involved. AI in fraud detection has revolutionized this sector by providing robust solutions for identifying and preventing various types of fraud, including identity theft, credit card fraud, and money laundering. Banks now use AI to analyze transaction data, monitor account activities, and verify identities with unprecedented accuracy.

- E-commerce In e-commerce, fraud detection is crucial to protect both retailers and consumers. AI systems help in monitoring online transactions, identifying fraudulent orders, and safeguarding payment processes. By analyzing customer behavior, purchase patterns, and transaction data, AI can detect and prevent fraudulent activities such as payment fraud, account takeovers, and fake reviews.

- Insurance The insurance industry faces significant challenges from fraudulent claims. AI-powered fraud detection systems analyze claim data, detect inconsistencies, and identify suspicious patterns that may indicate fraudulent activity. By employing machine learning algorithms, insurers can process claims more efficiently and accurately, reducing the risk of payouts on false claims.

- Telecommunications In the telecommunications industry, fraud can take the form of subscription fraud, premium rate service fraud, and SIM card cloning. AI helps telecom companies monitor network activities, detect irregular usage patterns, and prevent unauthorized access to services. This proactive approach not only protects the companies but also enhances customer trust and satisfaction.

The Future of AI in Fraud Detection

The future of AI in fraud detection looks promising, with ongoing advancements in machine learning, data analytics, and computing power. As AI technologies continue to evolve, their application in fraud detection will become even more sophisticated and effective. The integration of AI with other technologies, such as blockchain and biometrics, is expected to further enhance the security and reliability of fraud detection systems.

Furthermore, the development of explainable AI (XAI) is set to address one of the primary concerns surrounding AI systems: their opacity. Explainable AI aims to make AI decision-making processes transparent and understandable, fostering greater trust and acceptance among users and regulatory bodies.

Conclusion

The integration of AI in fraud detection represents a paradigm shift in the way businesses and institutions protect themselves against fraudulent activities. By leveraging advanced data analysis, real-time monitoring, behavioral analysis, and anomaly detection, AI systems offer a level of precision and efficiency that traditional methods cannot match. As AI technology continues to advance, its role in fraud detection will undoubtedly become more critical, ensuring enhanced security and trust in various sectors. Embracing AI in fraud detection is not just a technological upgrade; it is a necessity for staying ahead in an increasingly complex and digital world.

Leave a comment