Introduction

In recent years, the financial industry has experienced a seismic shift due to technological advancements, particularly in artificial intelligence (AI). AI in portfolio management has emerged as a game-changer, offering unprecedented opportunities for enhancing investment strategies, risk management, and decision-making processes. This article delves into the transformative impact of AI in portfolio management, exploring its benefits, applications, and the future of investment strategies.

The Evolution of Portfolio Management

Portfolio management traditionally relied on human expertise, intuition, and experience. Financial analysts and portfolio managers would meticulously analyze market trends, economic indicators, and company performance to make informed investment decisions. However, this process was often time-consuming, prone to human error, and limited by the sheer volume of data that could be processed manually.

The advent of AI has revolutionized this landscape. By leveraging machine learning algorithms, natural language processing, and predictive analytics, AI can analyze vast amounts of data at unprecedented speed and accuracy. This technological leap has paved the way for more sophisticated and data-driven investment strategies.

Benefits of AI in Portfolio Management

Enhanced Data Processing and Analysis

One of the most significant advantages of AI in portfolio management is its ability to process and analyze large datasets quickly. AI algorithms can sift through financial reports, news articles, social media posts, and market data to identify patterns and trends that might be missed by human analysts. This capability allows for more comprehensive and timely insights, enabling portfolio managers to make informed decisions based on real-time information.

Improved Risk Management

AI’s predictive capabilities are particularly valuable in risk management. Machine learning models can assess the potential risks associated with various investment options by analyzing historical data and identifying factors that could impact future performance. This enables portfolio managers to develop more effective risk mitigation strategies and make adjustments to portfolios proactively, rather than reactively.

Personalized Investment Strategies

AI in portfolio management also facilitates the creation of personalized investment strategies tailored to individual investors’ risk tolerance, financial goals, and preferences. By analyzing an investor’s financial behavior and preferences, AI can recommend investment options that align with their unique profile. This level of personalization enhances the investor experience and can lead to better long-term financial outcomes.

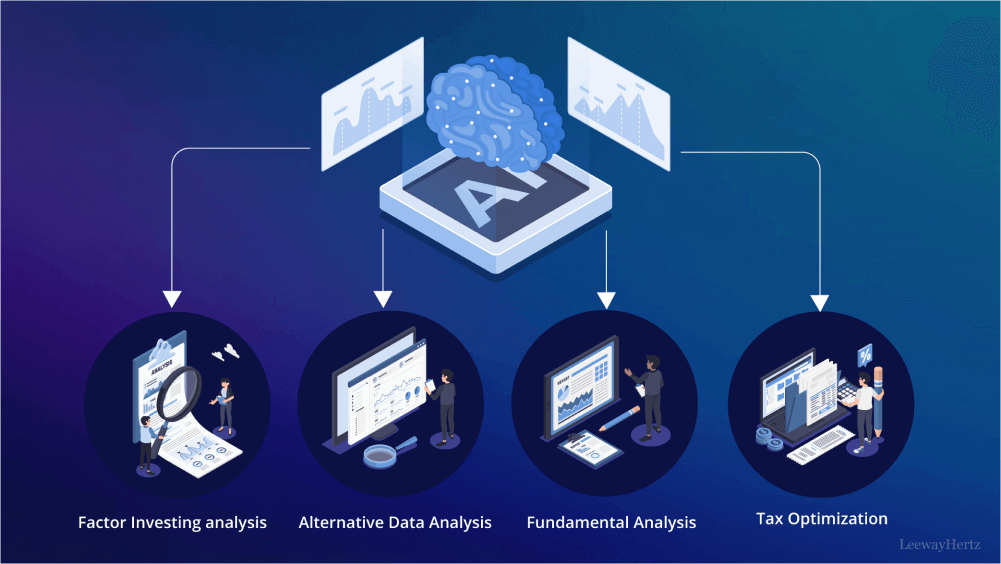

Applications of AI in Portfolio Management

Algorithmic Trading

Algorithmic trading, also known as algo-trading, is one of the most prominent applications of AI in portfolio management. AI-driven trading algorithms can execute trades at high speeds and frequencies, taking advantage of market inefficiencies and price discrepancies. These algorithms can also adapt to changing market conditions, making them more agile and responsive than traditional trading strategies.

Sentiment Analysis

Sentiment analysis involves using AI to gauge market sentiment by analyzing textual data from various sources, such as news articles, social media, and financial reports. By understanding the overall sentiment toward specific assets or market conditions, portfolio managers can make more informed decisions. For instance, positive sentiment around a particular stock might indicate a potential buying opportunity, while negative sentiment could signal a need for caution.

Predictive Analytics

Predictive analytics powered by AI can forecast future market trends and asset performance based on historical data and current market conditions. These predictions can help portfolio managers anticipate market movements and adjust their strategies accordingly. For example, if predictive models indicate an upcoming downturn in a particular sector, portfolio managers can reduce their exposure to that sector to minimize potential losses.

Challenges and Considerations

Data Quality and Availability

The effectiveness of AI in portfolio management largely depends on the quality and availability of data. Inaccurate or incomplete data can lead to flawed analyses and poor investment decisions. Therefore, ensuring access to reliable and comprehensive data sources is crucial for the successful implementation of AI-driven strategies.

Ethical and Regulatory Concerns

The use of AI in financial services raises several ethical and regulatory concerns. Issues such as data privacy, algorithmic bias, and transparency need to be addressed to build trust and ensure compliance with regulatory standards. Financial institutions must develop robust governance frameworks to manage these challenges effectively.

Human-AI Collaboration

While AI offers significant advantages, it is not a replacement for human expertise. The most effective portfolio management strategies often involve a combination of AI-driven insights and human judgment. Portfolio managers need to understand the limitations of AI and use it as a tool to augment their decision-making processes rather than relying on it entirely.

The Future of AI in Portfolio Management

The future of AI in portfolio management looks promising, with continuous advancements in technology poised to further enhance investment strategies. Here are some trends to watch for:

Increased Adoption of AI-Powered Tools

As AI technology becomes more accessible and affordable, we can expect a wider adoption of AI-powered tools across the financial industry. Smaller investment firms and individual investors will have the opportunity to leverage AI for portfolio management, democratizing access to sophisticated investment strategies.

Integration of Alternative Data Sources

The integration of alternative data sources, such as satellite imagery, IoT data, and geolocation data, into AI models will provide even deeper insights into market trends and asset performance. This will enable portfolio managers to make more informed and nuanced investment decisions.

Advancements in Explainable AI

Explainable AI (XAI) aims to make AI decision-making processes more transparent and understandable. As XAI technology evolves, portfolio managers will gain greater visibility into how AI models arrive at their recommendations, enhancing trust and enabling better oversight.

Conclusion

AI in portfolio management is transforming the way investment strategies are developed and executed. By harnessing the power of AI, portfolio managers can process vast amounts of data, improve risk management, and create personalized investment strategies. While challenges remain, the future of AI in portfolio management holds immense potential for innovation and growth. As technology continues to evolve, the collaboration between human expertise and AI will drive the financial industry toward more efficient and effective investment practices.

Leave a comment