How Artificial Intelligence is Transforming the Way Lenders Assess Creditworthiness

In today’s rapidly evolving financial landscape, AI-based credit scoring is emerging as a game-changer. This innovative technology leverages artificial intelligence (AI) to enhance the accuracy, efficiency, and fairness of credit assessments. Let’s explore how AI-based credit scoring is revolutionizing the financial industry and benefiting both lenders and borrowers.

Understanding AI-Based Credit Scoring

What is AI-Based Credit Scoring?

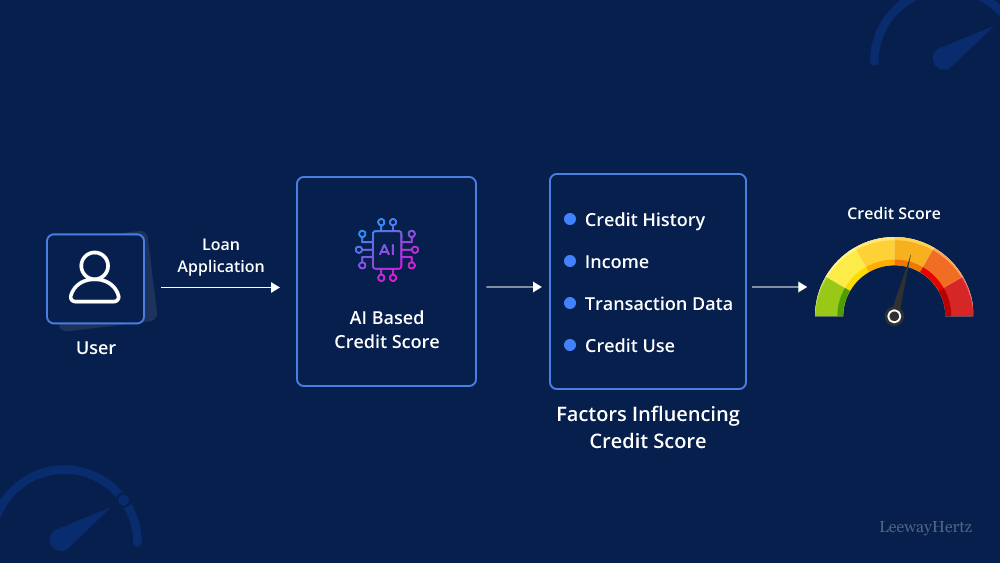

AI-based credit scoring utilizes machine learning algorithms and big data analytics to evaluate an individual’s creditworthiness. Traditional credit scoring models, such as FICO scores, primarily rely on a person’s credit history, including their payment history, outstanding debts, and length of credit history. In contrast, AI-based credit scoring incorporates a broader range of data points, providing a more comprehensive and nuanced picture of a borrower’s financial behavior.

How Does It Work?

AI-based credit scoring systems analyze a multitude of data sources beyond conventional credit reports. These sources can include social media activity, utility payments, rental history, and even behavioral patterns such as spending habits and digital footprints. Machine learning algorithms process this vast amount of information to identify patterns and correlations that may indicate creditworthiness. The result is a credit score that is potentially more accurate and reflective of a person’s true financial health.

The Benefits of AI-Based Credit Scoring

Improved Accuracy

One of the primary advantages of AI-based credit scoring is its ability to deliver more accurate assessments. By considering a wider array of data points, AI systems can detect subtle indicators of financial reliability that traditional models might overlook. This can lead to more precise credit scores and reduce the risk of misjudging a borrower’s ability to repay loans.

Greater Inclusivity

AI-based credit scoring opens up opportunities for individuals who might be underserved by traditional credit scoring methods. Many people, especially those with limited credit histories (often referred to as “credit invisibles”), may struggle to obtain loans under conventional systems. By incorporating alternative data sources, AI-based models can provide these individuals with fairer access to credit, fostering financial inclusion.

Enhanced Fraud Detection

AI algorithms excel at identifying unusual patterns that may indicate fraudulent activity. In credit scoring, this capability translates to improved fraud detection, helping lenders mitigate risks and protect themselves from potential losses. AI-based systems can quickly flag suspicious behaviors, allowing for timely intervention and investigation.

Challenges and Considerations

Data Privacy and Security

The use of extensive personal data in AI-based credit scoring raises important privacy and security concerns. It is crucial for financial institutions to implement robust data protection measures to safeguard sensitive information. Regulatory compliance and transparent data usage policies are essential to maintaining consumer trust and ensuring ethical practices.

Algorithmic Bias

AI systems are only as good as the data they are trained on. If the underlying data contains biases, the algorithms may inadvertently perpetuate those biases, leading to unfair outcomes. For instance, historical data reflecting discriminatory lending practices could result in biased credit scores. Continuous monitoring and refinement of AI models are necessary to minimize bias and promote fairness.

Regulatory Challenges

The adoption of AI-based credit scoring also presents regulatory challenges. Financial regulators must develop frameworks that balance innovation with consumer protection. Ensuring that AI systems are transparent, accountable, and compliant with existing laws is critical for their widespread acceptance and success.

The Future of AI-Based Credit Scoring

Advancements in AI Technology

As AI technology continues to advance, so will the capabilities of AI-based credit scoring systems. Future innovations may include even more sophisticated data analysis techniques and the integration of real-time data. These advancements could further enhance the accuracy and reliability of credit assessments.

Global Adoption

AI-based credit scoring is gaining traction worldwide. In developing countries, where traditional credit infrastructures may be lacking, AI offers a promising solution for expanding access to credit. By leveraging mobile and digital technologies, AI-based systems can reach a broader population and drive financial inclusion on a global scale.

Collaboration and Standardization

For AI-based credit scoring to reach its full potential, collaboration between financial institutions, technology providers, and regulators is essential. Establishing industry standards and best practices will help ensure consistency, reliability, and fairness across different AI systems. Collaborative efforts can also address common challenges and drive the ethical development of AI in finance.

Conclusion

AI-based credit scoring represents a significant leap forward in the financial industry, offering improved accuracy, inclusivity, and fraud detection. While challenges such as data privacy, algorithmic bias, and regulatory compliance need to be addressed, the potential benefits of AI-based credit scoring are immense. As technology continues to evolve, AI-based credit scoring is poised to become an integral part of the credit assessment landscape, transforming the way lenders and borrowers interact in the financial ecosystem.

In summary, AI-based credit scoring is not just a technological innovation; it is a catalyst for a more inclusive and efficient financial system. By embracing this technology, we can create a future where access to credit is fairer and more equitable for all.

Leave a comment