Introduction

In recent years, the integration of artificial intelligence (AI) into various industries has sparked significant advancements and efficiency gains. One such industry experiencing a transformative change is debt collection. Traditionally viewed as a labor-intensive and often confrontational process, debt collection is now benefiting from the precision, efficiency, and effectiveness of AI. This article explores how AI in debt collection is revolutionizing the industry, making the process more efficient, less invasive, and ultimately more successful for both creditors and debtors.

The Traditional Challenges of Debt Collection

Debt collection has long been associated with numerous challenges. The process involves locating debtors, initiating contact, negotiating repayment terms, and ensuring compliance with legal regulations. Human agents tasked with these responsibilities often face difficulties in managing large volumes of cases, leading to inefficiencies and inconsistencies in debt recovery. Additionally, the confrontational nature of traditional debt collection methods can strain relationships between creditors and debtors, making it harder to achieve amicable resolutions.

The Role of AI in Debt Collection

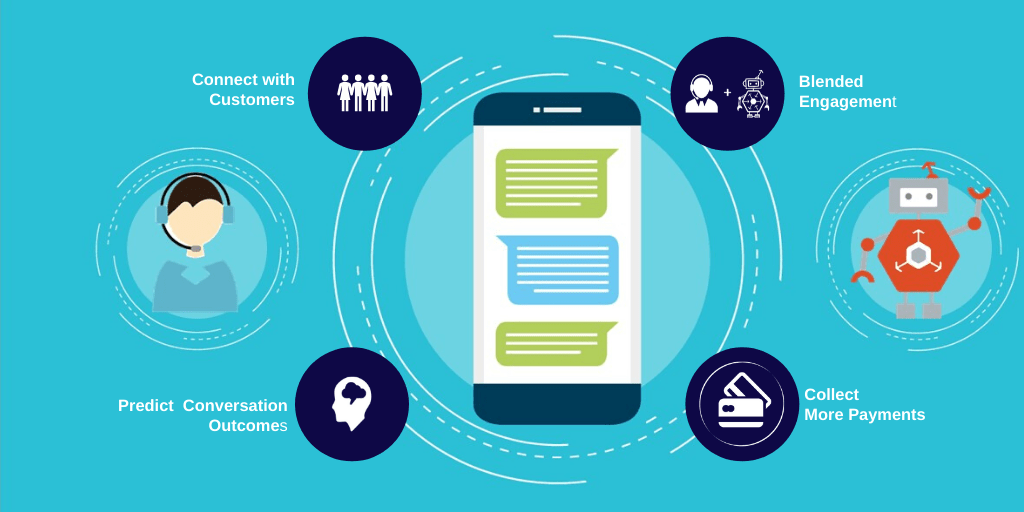

AI technology is now addressing many of the challenges faced by the debt collection industry. By leveraging machine learning algorithms and data analytics, AI can automate and optimize various aspects of the debt collection process. Here are some key ways AI is making a difference:

1. Enhanced Data Analysis and Segmentation

AI systems can analyze vast amounts of data to segment debtors based on various criteria, such as their payment history, credit score, and communication preferences. This segmentation allows debt collectors to tailor their approach to each debtor, increasing the likelihood of successful debt recovery. For example, AI can identify debtors who are more likely to respond to digital communication methods versus those who prefer phone calls.

2. Predictive Analytics for Debt Recovery

Predictive analytics, powered by AI, enables debt collectors to forecast the likelihood of debt recovery from specific debtors. By analyzing historical data and identifying patterns, AI can provide insights into which debtors are more likely to repay their debts and which ones might require more intensive follow-up. This targeted approach helps prioritize efforts and allocate resources more effectively.

3. Automated Communication and Negotiation

AI-powered chatbots and virtual assistants are becoming increasingly common in debt collection. These tools can handle routine communications, such as sending reminders, answering frequently asked questions, and negotiating repayment plans. By automating these tasks, human agents can focus on more complex cases, thereby improving overall efficiency. Additionally, AI-driven communication is often less intrusive, reducing the stress and anxiety for debtors.

4. Compliance and Legal Adherence

Debt collection is a heavily regulated industry, with stringent laws governing how and when debtors can be contacted. AI can help ensure compliance with these regulations by automatically monitoring communication practices and generating reports for auditing purposes. This reduces the risk of legal issues and enhances the credibility of debt collection agencies.

5. Improved Customer Experience

The use of AI in debt collection is also transforming the customer experience. By providing personalized and empathetic communication, AI can foster a more positive relationship between creditors and debtors. For instance, AI can analyze a debtor’s financial situation and suggest customized repayment plans that are more manageable. This approach not only improves the likelihood of debt recovery but also helps maintain the debtor’s dignity and trust.

Case Studies and Success Stories

Several debt collection agencies have already successfully implemented AI technology, witnessing substantial improvements in their operations. For example, a leading financial institution integrated AI-driven predictive analytics into their debt collection process. As a result, they experienced a 20% increase in debt recovery rates and a significant reduction in the time spent on each case. Another agency employed AI-powered chatbots to handle initial communications, freeing up their human agents to focus on high-priority cases. This led to improved efficiency and higher overall satisfaction rates among debtors.

Challenges and Considerations

While AI in debt collection offers numerous benefits, it is essential to acknowledge the challenges and considerations associated with its implementation. Data privacy and security are paramount, as debt collection involves sensitive financial information. Ensuring that AI systems comply with data protection regulations is crucial to maintaining trust and avoiding legal repercussions. Additionally, there is a need for ongoing monitoring and refinement of AI algorithms to ensure they remain accurate and effective over time.

The Future of AI in Debt Collection

The future of AI in debt collection looks promising, with continuous advancements in technology likely to further enhance the efficiency and effectiveness of the process. As AI systems become more sophisticated, they will be able to handle increasingly complex tasks, such as predicting debtor behavior with greater accuracy and developing more personalized communication strategies. Moreover, the integration of AI with other emerging technologies, such as blockchain and digital identity verification, will further streamline and secure the debt collection process.

Conclusion

AI in debt collection is revolutionizing the industry, offering a range of benefits from enhanced data analysis and predictive analytics to improved customer experience and compliance. By automating routine tasks and providing valuable insights, AI is making debt collection more efficient, less invasive, and ultimately more successful. As technology continues to evolve, the role of AI in debt collection will only grow, paving the way for a more streamlined and effective approach to financial recovery.

Leave a comment