Introduction: Navigating the Regulatory Landscape

In today’s rapidly evolving business environment, regulatory compliance has become increasingly complex. Organizations across various industries face stringent regulations and must ensure that they adhere to these standards to avoid hefty fines and reputational damage. Enter Artificial Intelligence (AI), a transformative technology offering unprecedented solutions for regulatory compliance. This article explores the significant role AI plays in regulatory compliance, simplifying processes, reducing risks, and enhancing efficiency.

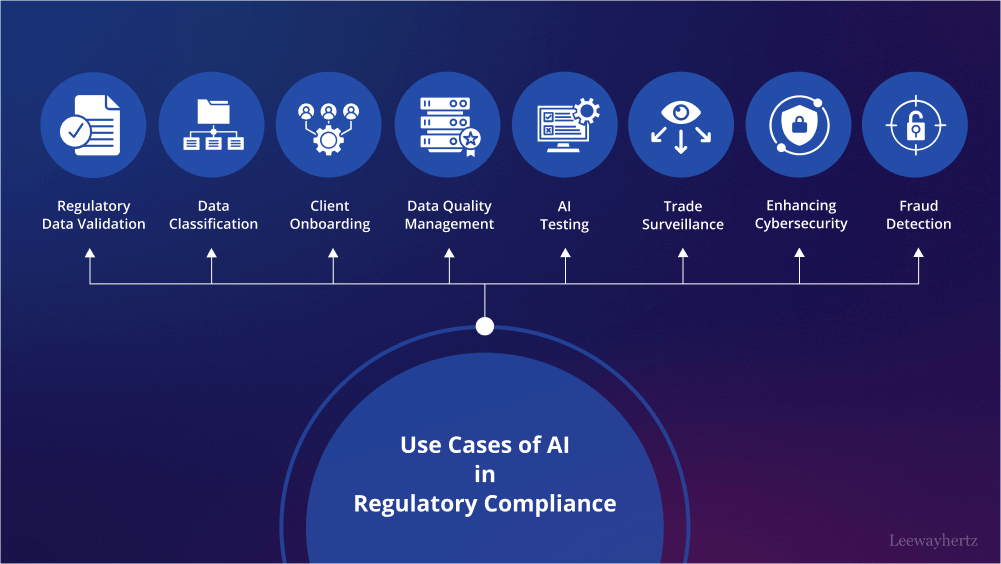

Understanding AI for Regulatory Compliance

AI for regulatory compliance refers to the use of artificial intelligence technologies to help organizations adhere to legal and regulatory standards. AI can automate and streamline many compliance-related tasks, from monitoring and reporting to risk assessment and remediation. This not only helps in maintaining compliance but also in proactively identifying and mitigating potential risks.

Automation of Compliance Tasks

One of the most significant advantages of AI for regulatory compliance is its ability to automate repetitive tasks. Compliance processes often involve extensive documentation, monitoring, and reporting, which can be time-consuming and prone to human error. AI-powered systems can automate these tasks, ensuring accuracy and freeing up human resources for more strategic activities.

For example, AI can automatically review transactions for compliance with anti-money laundering (AML) regulations, flagging suspicious activities for further investigation. Similarly, AI can monitor communications within an organization to detect potential breaches of regulatory policies.

Enhanced Risk Management

AI enhances risk management by providing more accurate and timely insights. Traditional risk management relies heavily on historical data and manual analysis, which can be slow and limited in scope. AI, on the other hand, can analyze vast amounts of data in real-time, identifying patterns and anomalies that might indicate potential risks.

Machine learning algorithms, a subset of AI, can predict future risks based on historical data and current trends. This predictive capability allows organizations to take proactive measures, mitigating risks before they escalate into significant issues. For instance, AI can predict compliance risks related to financial transactions or data breaches, enabling organizations to address vulnerabilities proactively.

Improving Data Management and Analysis

Regulatory compliance requires organizations to manage and analyze large volumes of data. AI excels in handling big data, making it an invaluable tool for compliance. AI-driven data management systems can automatically collect, organize, and analyze data from various sources, ensuring that it meets regulatory standards.

Natural language processing (NLP), another AI technology, can be used to analyze unstructured data such as emails, contracts, and social media posts. NLP can identify relevant information, flag potential compliance issues, and provide actionable insights. This capability is particularly useful in industries such as finance and healthcare, where regulatory requirements are stringent, and data volumes are enormous.

Facilitating Real-Time Monitoring and Reporting

AI enables real-time monitoring and reporting, a crucial aspect of regulatory compliance. Traditional compliance monitoring is often retrospective, identifying issues only after they have occurred. AI, however, can provide continuous monitoring, detecting and addressing compliance issues as they arise.

For example, in the financial sector, AI can monitor transactions in real-time, ensuring compliance with regulations such as the General Data Protection Regulation (GDPR) or the Dodd-Frank Act. This real-time capability helps organizations avoid regulatory breaches and respond promptly to any compliance concerns.

Supporting Regulatory Change Management

Regulations are constantly evolving, and organizations must stay abreast of these changes to remain compliant. AI can assist in regulatory change management by tracking changes in regulations and updating compliance processes accordingly. AI-powered systems can analyze new regulations, identify the necessary changes, and implement them across the organization.

This capability is particularly valuable in highly regulated industries such as finance, healthcare, and pharmaceuticals, where staying compliant with ever-changing regulations is a continuous challenge. AI ensures that organizations can adapt quickly to regulatory changes, maintaining compliance without significant disruptions.

Challenges and Considerations

While AI offers significant benefits for regulatory compliance, it is not without challenges. Implementing AI systems requires substantial investment in technology and training. Organizations must also ensure data privacy and security, as AI systems often handle sensitive information.

Moreover, AI is only as good as the data it is trained on. Poor quality or biased data can lead to inaccurate results and compliance risks. Therefore, organizations must invest in high-quality data and regularly update AI systems to reflect current regulatory standards and business practices.

Conclusion: Embracing the Future of Compliance

AI for regulatory compliance is transforming the way organizations manage their regulatory obligations. By automating tasks, enhancing risk management, improving data analysis, and facilitating real-time monitoring, AI is helping organizations stay compliant in an increasingly complex regulatory landscape.

Despite the challenges, the benefits of AI for regulatory compliance far outweigh the drawbacks. As AI technology continues to advance, its role in regulatory compliance will only grow, making it an indispensable tool for organizations worldwide. Embracing AI for regulatory compliance is not just a strategic advantage but a necessity in the modern business environment.

Leave a comment