Introduction

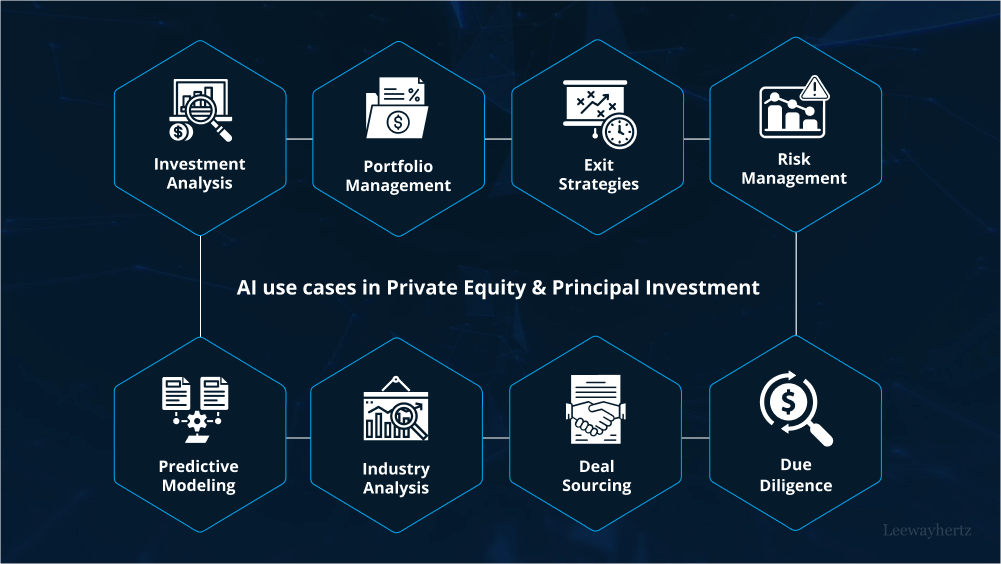

Artificial Intelligence (AI) has emerged as a transformative force across various industries, and private equity & principal investment is no exception. Leveraging AI in private equity & principal investment is reshaping how firms identify opportunities, manage portfolios, and drive value creation. This article explores the multifaceted role of AI in this sector and how it is optimizing decision-making processes, enhancing efficiency, and generating superior returns.

Revolutionizing Deal Sourcing and Due Diligence

Enhanced Deal Sourcing

AI in private equity & principal investment is revolutionizing deal sourcing by automating the identification of potential investment targets. Traditionally, deal sourcing relied heavily on manual research and networking, which is both time-consuming and prone to human error. AI algorithms, however, can swiftly analyze vast amounts of data from various sources, such as financial reports, news articles, and market trends, to pinpoint promising investment opportunities. This not only speeds up the process but also ensures a more comprehensive and objective evaluation of potential deals.

Streamlined Due Diligence

Due diligence is a critical step in the investment process, involving the assessment of a target company’s financial health, operational efficiency, and market position. AI in private equity & principal investment enhances due diligence by automating data collection and analysis. Machine learning models can quickly identify discrepancies, detect fraud, and assess risks by analyzing historical data, financial statements, and other relevant documents. This leads to more informed decision-making and reduces the likelihood of overlooking critical issues.

Optimizing Portfolio Management

Predictive Analytics for Performance Monitoring

Once an investment is made, effective portfolio management is crucial for maximizing returns. AI in private equity & principal investment enables predictive analytics, allowing firms to monitor the performance of their portfolio companies in real-time. By analyzing key performance indicators (KPIs), market conditions, and other relevant data, AI systems can predict future performance trends and identify potential challenges before they escalate. This proactive approach enables investors to take timely corrective actions and optimize the performance of their investments.

Operational Efficiency and Cost Reduction

AI-driven automation also plays a significant role in enhancing the operational efficiency of portfolio companies. From streamlining supply chain management to optimizing marketing strategies, AI can identify inefficiencies and suggest improvements that lead to cost reduction and increased profitability. For example, AI-powered chatbots can handle customer service inquiries, freeing up human resources for more strategic tasks, while predictive maintenance can reduce downtime and maintenance costs in manufacturing operations.

Driving Value Creation and Exits

Strategic Insights and Value Creation

AI in private equity & principal investment goes beyond operational efficiency to drive value creation. Advanced data analytics provide strategic insights that can inform growth strategies, market expansion, and product development. By leveraging AI to analyze market trends and consumer behavior, firms can identify new revenue streams and tailor their offerings to meet evolving customer needs. This data-driven approach enhances the value of portfolio companies and positions them for successful exits.

Optimized Exit Strategies

Exiting an investment at the right time and under favorable conditions is essential for maximizing returns. AI in private equity & principal investment assists in devising optimized exit strategies by analyzing market conditions, competitor actions, and potential buyers. Machine learning models can predict the optimal timing for an exit and identify the most suitable buyers based on their historical acquisition patterns and financial health. This ensures that investors can achieve the highest possible return on their investments.

Challenges and Future Outlook

Addressing Challenges

While the benefits of AI in private equity & principal investment are substantial, there are challenges to address. Data privacy and security concerns, the need for significant initial investments in AI technology, and the potential for job displacement are among the key issues. Firms must adopt robust data governance practices, ensure transparency in AI decision-making, and invest in reskilling their workforce to mitigate these challenges.

Future Prospects

The future of AI in private equity & principal investment looks promising, with continuous advancements in AI technologies and increasing adoption across the industry. As AI algorithms become more sophisticated and capable of handling complex tasks, their impact on investment processes will only grow. Firms that embrace AI and integrate it into their operations will be better positioned to gain a competitive edge, achieve superior returns, and drive innovation in the private equity & principal investment landscape.

Conclusion

AI in private equity & principal investment is transforming the industry by enhancing deal sourcing, streamlining due diligence, optimizing portfolio management, and driving value creation. Despite the challenges, the benefits of integrating AI into investment processes are undeniable. As AI technology continues to evolve, its role in private equity & principal investment will become increasingly pivotal, shaping the future of the industry and unlocking new opportunities for growth and success.

Leave a comment