Introduction

In today’s rapidly evolving business landscape, compliance remains a crucial concern for organizations across various industries. With the increasing complexity of regulations, companies face mounting challenges in maintaining compliance. This is where AI agents in compliance come into play, offering innovative solutions to streamline processes, enhance accuracy, and reduce risks. In this article, we will explore how AI agents in compliance are transforming the way businesses operate, ensuring adherence to regulations while optimizing efficiency.

Understanding AI Agents in Compliance

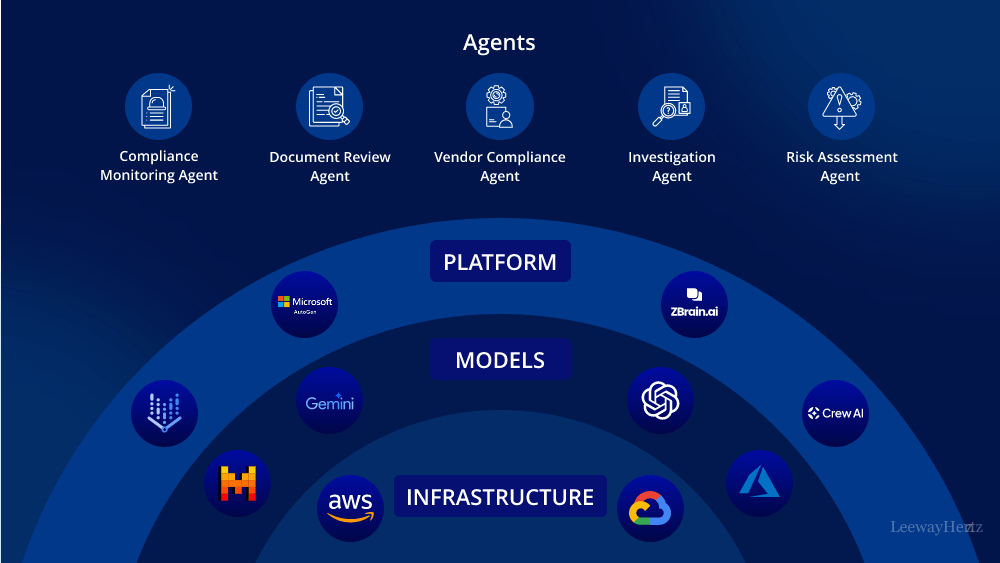

AI agents in compliance are intelligent systems that use artificial intelligence to automate and enhance compliance-related tasks. These agents leverage machine learning, natural language processing, and data analytics to analyze vast amounts of data, detect potential risks, and ensure that businesses adhere to regulatory requirements. By automating repetitive and time-consuming tasks, AI agents in compliance free up human resources, allowing organizations to focus on more strategic activities.

Key Benefits of AI Agents in Compliance

- Enhanced Efficiency and Accuracy One of the primary advantages of AI agents in compliance is their ability to process large volumes of data quickly and accurately. Traditional compliance processes often involve manual reviews and checks, which are not only time-consuming but also prone to errors. AI agents can scan documents, analyze transactions, and cross-check information against regulatory guidelines in a fraction of the time it would take a human. This results in faster compliance checks and reduces the risk of human error.

- Proactive Risk Management AI agents in compliance are not just reactive tools; they are also proactive in identifying potential risks before they escalate into major issues. Through continuous monitoring and analysis, these agents can flag suspicious activities, irregularities, or deviations from standard practices. For example, in financial institutions, AI agents can detect unusual transactions that may indicate fraudulent activities or money laundering, allowing organizations to take immediate action.

- Cost Reduction Implementing AI agents in compliance can lead to significant cost savings for businesses. Manual compliance processes require extensive human resources, which can be costly. By automating these processes, AI agents reduce the need for large compliance teams, thereby cutting labor costs. Additionally, the accuracy and speed of AI agents minimize the risk of costly compliance breaches and the associated fines or legal fees.

- Scalability and Adaptability As businesses grow and regulations evolve, compliance requirements can become increasingly complex. AI agents in compliance offer scalability, allowing organizations to adapt to changing needs without a complete overhaul of their compliance systems. These agents can be trained to handle new regulations, integrate with existing systems, and scale operations as needed, making them a flexible solution for businesses of all sizes.

Applications of AI Agents in Compliance

- Regulatory Reporting and Auditing AI agents in compliance are widely used in regulatory reporting and auditing processes. They can automate the generation of reports, ensuring that all required information is accurately captured and submitted on time. AI agents also assist in auditing by reviewing financial records, identifying discrepancies, and ensuring adherence to accounting standards.

- Customer Due Diligence and KYC Know Your Customer (KYC) processes are critical in industries such as banking and finance. AI agents in compliance streamline KYC procedures by verifying customer identities, analyzing data, and assessing potential risks associated with clients. This not only speeds up the onboarding process but also ensures that businesses remain compliant with anti-money laundering (AML) regulations.

- Policy and Procedure Management AI agents in compliance help organizations manage their internal policies and procedures effectively. They can monitor policy adherence, update procedures in line with new regulations, and provide employees with easy access to compliance-related information. This ensures that all staff members are aware of and adhere to the latest compliance requirements.

Challenges and Considerations

While AI agents in compliance offer numerous benefits, it is important to acknowledge the challenges associated with their implementation. One key concern is data privacy and security. AI agents rely on large datasets to function effectively, and safeguarding this data is crucial to prevent breaches. Organizations must ensure that their AI systems comply with data protection regulations to maintain customer trust.

Additionally, while AI agents can automate many compliance tasks, human oversight remains essential. AI systems can sometimes produce false positives or miss subtle nuances that a human expert would catch. Therefore, a balanced approach that combines AI-driven automation with human expertise is recommended for optimal compliance management.

Conclusion

AI agents in compliance are revolutionizing the way businesses handle regulatory requirements. By enhancing efficiency, accuracy, and scalability, these intelligent systems offer a powerful solution for managing compliance in an increasingly complex environment. As technology continues to advance, the role of AI agents in compliance will only grow, providing organizations with the tools they need to stay ahead of regulatory changes and maintain a strong compliance posture. Embracing AI agents in compliance is not just a trend; it is a strategic move towards a more efficient and secure future for businesses worldwide.

Leave a comment