Introduction to Generative AI in Finance and Banking

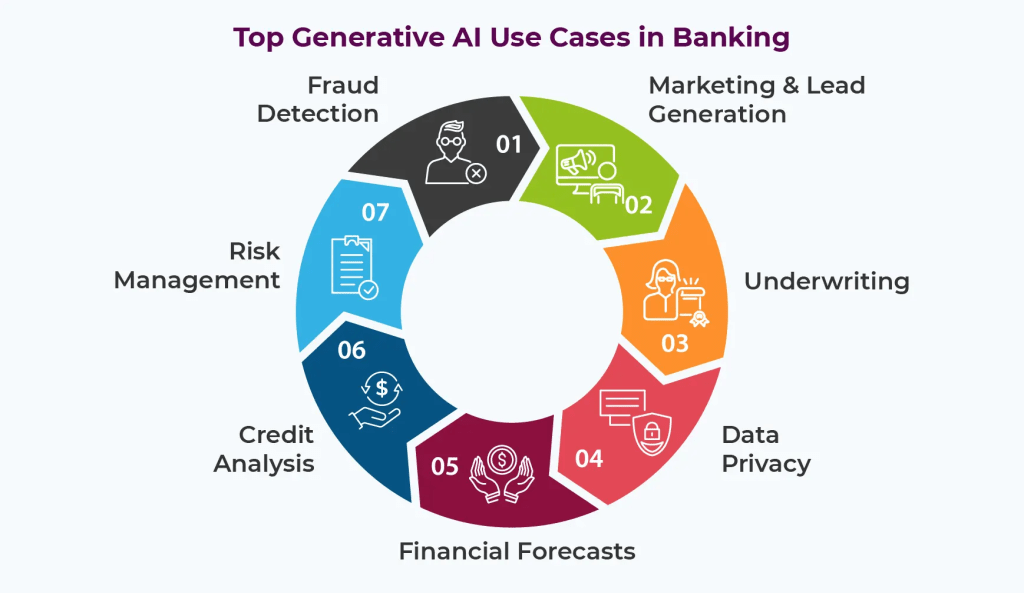

Generative AI is rapidly transforming various industries, and finance and banking are no exceptions. This innovative technology leverages algorithms to create new content, analyze data, and provide solutions that enhance operational efficiency. By integrating generative AI into their systems, financial institutions can streamline processes, improve customer experiences, and make informed decisions based on real-time data.

Enhancing Customer Service with Generative AI

One of the most significant advantages of generative AI in finance and banking is its ability to enhance customer service. Chatbots and virtual assistants powered by generative AI can handle a wide range of customer inquiries, from basic account questions to more complex financial advice. These AI-driven solutions provide immediate responses, ensuring that customers receive the information they need without lengthy wait times.

Furthermore, generative AI can analyze customer interactions to personalize services. By understanding customer preferences and behaviors, financial institutions can tailor their offerings, making recommendations that resonate with individual needs. This personalization not only improves customer satisfaction but also fosters loyalty and trust.

Risk Management and Fraud Detection

Another critical application of generative AI in finance and banking is in risk management and fraud detection. Financial institutions face constant threats from fraudulent activities, and traditional methods of detection can be slow and ineffective. Generative AI excels in identifying patterns within vast datasets, allowing for more accurate predictions of fraudulent behavior.

By continuously learning from new data, generative AI models can adapt to emerging threats. This proactive approach helps banks to not only detect fraud in real time but also mitigate risks before they escalate. Additionally, these systems can assist in regulatory compliance by analyzing transactions and ensuring they meet established guidelines, further protecting institutions from potential penalties.

Streamlining Operations and Decision-Making

Generative AI is also proving invaluable in streamlining operations within finance and banking. Routine tasks, such as data entry and document processing, can be automated using generative AI technologies. This automation reduces human error and frees up staff to focus on more strategic initiatives, ultimately increasing overall productivity.

Moreover, generative AI aids in decision-making by providing actionable insights derived from complex data analyses. Financial analysts can leverage these insights to make informed investment decisions, optimize portfolios, and forecast market trends. This data-driven approach not only enhances the accuracy of predictions but also supports strategic planning within organizations.

Creating Innovative Financial Products

Generative AI in finance and banking is paving the way for the development of innovative financial products. By analyzing market trends and consumer behavior, generative AI can help financial institutions identify gaps in the market and create tailored solutions to meet customer needs. This could range from personalized loan offerings to customized investment portfolios.

The ability to simulate various financial scenarios using generative AI models enables banks to test the viability of new products before launch. This minimizes risk and ensures that the offerings are aligned with customer expectations. As a result, financial institutions can stay competitive in an ever-evolving market.

Addressing Ethical Concerns

While the potential benefits of generative AI in finance and banking are substantial, it is essential to address the ethical concerns associated with its use. Issues such as data privacy, algorithmic bias, and the transparency of AI decisions must be carefully considered. Financial institutions need to implement robust ethical guidelines to ensure that generative AI is used responsibly.

To build trust with customers, transparency in AI-driven processes is crucial. Financial institutions should communicate how generative AI impacts their services and the measures taken to protect customer data. By prioritizing ethical practices, banks can enhance their reputations and foster a culture of responsibility.

Conclusion: The Future of Generative AI in Finance and Banking

The integration of generative AI in finance and banking is not just a trend; it represents a significant shift in how financial services are delivered. From enhancing customer service to improving risk management and streamlining operations, generative AI is set to revolutionize the industry.

As financial institutions continue to adopt this technology, the focus must remain on ethical implementation and customer-centric approaches. By doing so, banks can harness the full potential of generative AI, creating a more efficient, innovative, and trustworthy financial ecosystem. As we look to the future, the role of generative AI in finance and banking will undoubtedly expand, offering new opportunities for growth and improvement.

Leave a comment