Introduction to Generative AI in Financial Reporting

Generative AI in financial reporting is transforming how organizations generate, analyze, and present financial data. By leveraging advanced algorithms, this technology automates repetitive tasks, enhances accuracy, and provides deeper insights, ultimately leading to more informed decision-making. In this article, we explore the various applications and benefits of generative AI in financial reporting.

Understanding Generative AI

Generative AI refers to algorithms that can create new content, including text, images, and data. In the context of financial reporting, generative AI can produce narratives, summarize financial information, and generate visualizations. This capability is particularly valuable in an industry that often deals with large volumes of data and requires timely insights.

Streamlining Financial Reporting Processes

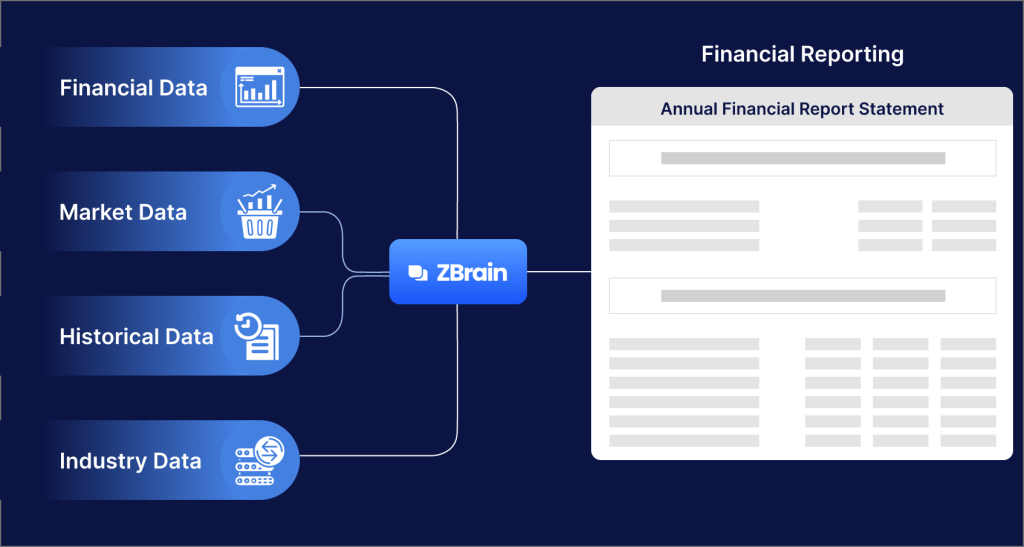

One of the primary advantages of using generative AI in financial reporting is the automation of data entry and report generation. Traditionally, financial analysts spend significant time compiling data from various sources, ensuring its accuracy, and creating reports. Generative AI can automate these processes, allowing analysts to focus on more strategic tasks.

For instance, generative AI can quickly pull data from multiple systems, such as accounting software and enterprise resource planning (ERP) systems, to create accurate financial statements. This not only saves time but also reduces the risk of human error, leading to more reliable reporting.

Enhancing Data Analysis

Another critical application of generative AI in financial reporting is its ability to enhance data analysis. By analyzing vast amounts of financial data, generative AI can identify trends, patterns, and anomalies that may not be immediately apparent to human analysts. This capability enables organizations to make data-driven decisions with greater confidence.

Moreover, generative AI can simulate various financial scenarios, helping organizations understand the potential impacts of different business decisions. By forecasting future performance based on historical data, companies can better prepare for uncertainties and optimize their strategies accordingly.

Improving Reporting Accuracy

Accuracy is paramount in financial reporting, and generative AI plays a vital role in ensuring that reports are both accurate and consistent. Traditional reporting methods often involve manual data manipulation, which can lead to discrepancies and errors. With generative AI, financial data is processed in real-time, significantly reducing the risk of inaccuracies.

Furthermore, generative AI can cross-reference data across different reports and sources, providing a higher level of assurance that the figures presented are correct. This reliability is crucial for stakeholders who rely on financial reports to make informed decisions.

Customizing Financial Reports

Generative AI in financial reporting also allows for greater customization of reports. Different stakeholders have varying information needs, and generative AI can tailor reports to meet these specific requirements. Whether it’s creating detailed reports for management or simplified summaries for external stakeholders, generative AI can adapt the content and presentation style accordingly.

Additionally, the ability to generate visual representations of data, such as charts and graphs, enhances the readability of financial reports. These visualizations help stakeholders quickly grasp complex financial information, making it easier to understand the company’s performance and outlook.

Ensuring Compliance and Reducing Risks

Compliance with financial regulations is another area where generative AI in financial reporting proves beneficial. The financial landscape is heavily regulated, and organizations must adhere to various reporting standards and guidelines. Generative AI can assist in ensuring that reports comply with these regulations by automatically checking for compliance issues during the report generation process.

By identifying potential compliance risks before the reports are submitted, generative AI helps organizations mitigate legal and financial repercussions. This proactive approach not only reduces risks but also builds trust with stakeholders and regulators.

Enhancing Collaboration and Communication

Effective communication and collaboration among finance teams are essential for accurate financial reporting. Generative AI can facilitate this by providing a centralized platform where team members can access and collaborate on financial data in real time. This transparency enhances teamwork and ensures that everyone is working with the same information.

Moreover, generative AI can automate the distribution of financial reports to relevant stakeholders, ensuring that they receive timely updates. This efficiency promotes better communication and keeps all parties informed, ultimately leading to more cohesive decision-making.

Conclusion

The integration of generative AI in financial reporting is revolutionizing the way organizations manage and present financial data. By automating processes, enhancing analysis, improving accuracy, and ensuring compliance, generative AI is empowering finance teams to operate more efficiently and effectively. As this technology continues to evolve, its impact on financial reporting will likely grow, further enhancing the capabilities of finance professionals and the organizations they serve. Embracing generative AI in financial reporting is no longer a choice but a necessity for organizations looking to thrive in today’s data-driven world.

Leave a comment