Introduction

In recent years, AI agents have dramatically transformed the finance industry, enabling organizations to streamline operations, make more informed decisions, and achieve unprecedented levels of efficiency. With capabilities that range from automated customer support to real-time data analysis, AI agents for finance are rapidly becoming indispensable tools for individuals and institutions alike. This article explores the growing influence of AI agents in finance, covering their applications, benefits, and the future of AI-driven financial services.

What Are AI Agents for Finance?

AI agents are software systems designed to simulate human-like decision-making processes, drawing on extensive data analysis to automate tasks and provide actionable insights. In finance, these agents work as digital assistants, handling complex calculations, monitoring financial markets, and optimizing resource allocation based on continuously evolving data. Unlike traditional software, AI agents are capable of learning from data patterns, improving accuracy over time, and adapting to new information. This adaptability allows AI agents for finance to efficiently support tasks ranging from transaction processing to portfolio management.

Key Applications of AI Agents in Financial Services

The implementation of AI agents in finance has led to notable advancements in multiple areas, with far-reaching impacts on productivity, cost-efficiency, and customer satisfaction. Some of the most prominent applications include:

1. Customer Support and Personal Finance Management

AI agents for finance play a critical role in enhancing customer service within financial institutions. They streamline support processes by answering frequently asked questions, assisting customers in real-time, and providing personalized financial advice. These virtual agents can manage tasks such as setting up new accounts, checking balances, and offering savings or investment recommendations based on each customer’s unique financial behavior. With AI-driven personalization, customers receive guidance that aligns with their financial goals and risk tolerance, making financial management simpler and more effective.

2. Fraud Detection and Risk Management

Fraud detection has always been a top priority in finance, and AI agents have elevated this capability to new heights. By analyzing transaction data in real time, AI agents for finance can quickly identify unusual patterns or transactions that may indicate fraud. These systems use machine learning algorithms to understand what constitutes a “normal” transaction for each account, flagging anything out of the ordinary. This approach allows financial institutions to respond to potential fraud instantly, safeguarding customers and reducing operational risks.

Beyond fraud detection, AI agents are essential in risk assessment for loans, investments, and credit. By evaluating an individual’s or entity’s financial history, market trends, and macroeconomic indicators, AI agents assist financial professionals in making informed decisions that minimize risk exposure.

3. Investment and Portfolio Management

AI agents have reshaped investment management, particularly in handling complex portfolios. They continuously monitor market conditions, review financial reports, and analyze vast quantities of data to recommend or execute investment decisions. These agents use predictive analytics to anticipate market shifts and optimize portfolio performance, allowing investors to achieve their financial objectives more consistently. From individual investors to large-scale hedge funds, AI agents for finance facilitate real-time, data-driven strategies that were previously impossible with traditional methods.

4. Algorithmic Trading

Algorithmic trading is one of the most advanced applications of AI agents for finance, enabling institutions to automate trading activities based on predetermined strategies and market conditions. These AI agents use complex algorithms to analyze market trends and execute trades in real time, often completing transactions faster than human traders. By leveraging AI, institutions benefit from enhanced trading accuracy, speed, and the ability to operate 24/7. This efficiency translates into increased profitability and reduced reliance on manual trading.

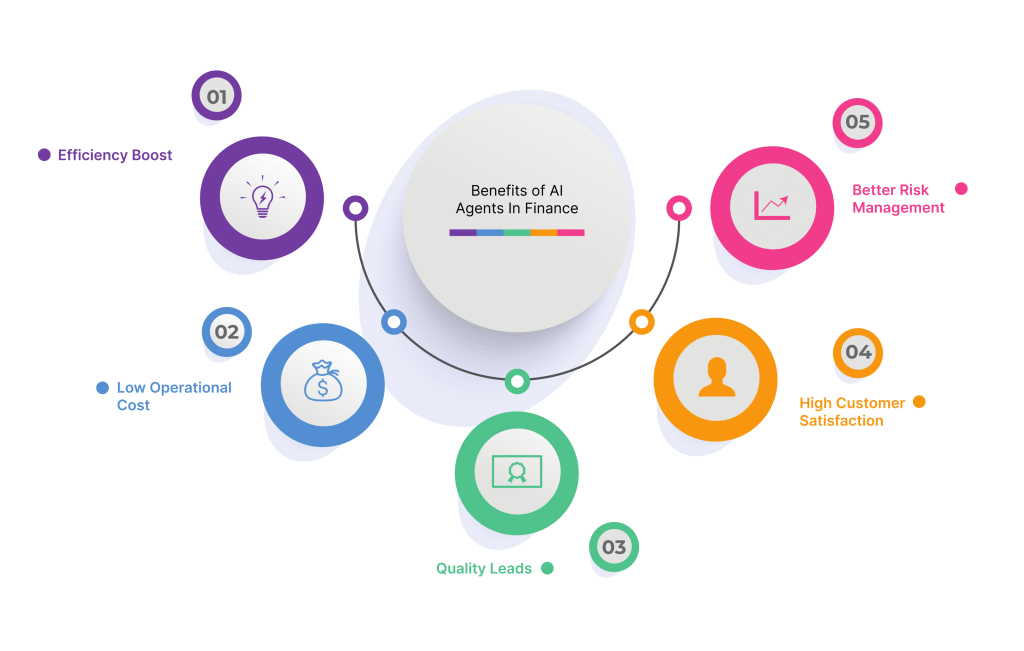

The Benefits of AI Agents for Finance

AI agents bring a host of benefits to financial institutions, helping them to adapt and thrive in a rapidly changing market environment. Key advantages include:

1. Enhanced Efficiency

Automating routine tasks allows financial professionals to focus on more strategic work. AI agents in finance handle everything from transaction processing to customer support inquiries, freeing up human resources and significantly reducing operational costs.

2. Improved Decision-Making

The decision-making capabilities of AI agents provide a considerable advantage, particularly when it comes to managing portfolios or evaluating loan applications. These agents can analyze millions of data points instantly, providing insights that help finance professionals make accurate, data-driven decisions. This ability reduces the likelihood of human error, contributing to better overall financial outcomes.

3. Personalization and Client Satisfaction

AI agents for finance enable a high degree of personalization in customer interactions. By analyzing individual preferences and behaviors, AI agents can offer tailored advice, making clients feel valued and understood. This personalized experience boosts customer satisfaction, helping institutions build loyalty and attract new clients.

4. Cost Savings and Increased Profitability

Cost reduction is a crucial benefit of deploying AI agents in finance. By handling repetitive and time-consuming tasks, AI agents reduce the need for extensive human intervention, leading to cost savings that can be passed on to customers or reinvested in other areas of the business. Furthermore, by providing accurate insights and increasing the efficiency of trading and investment operations, AI agents can significantly boost profitability.

Future Trends in AI Agents for Finance

The evolution of AI agents for finance is ongoing, with promising developments on the horizon. Some of the most impactful trends include:

1. Integration with Blockchain and Cryptocurrencies

As blockchain and cryptocurrency gain traction, AI agents will likely play a key role in managing digital assets and monitoring transactions on decentralized platforms. The convergence of AI and blockchain has the potential to create more transparent, secure, and efficient financial systems.

2. Enhanced Regulatory Compliance

AI agents are also poised to enhance regulatory compliance, assisting financial institutions in managing complex legal requirements. By tracking and analyzing regulatory changes in real-time, these agents ensure that organizations remain compliant while minimizing the risk of costly fines and penalties.

3. AI-Powered Financial Advising

In the near future, AI agents may serve as digital financial advisors, offering individuals customized financial plans based on real-time market data and personal goals. This evolution could democratize access to financial advice, making personalized financial planning available to a wider audience.

Conclusion

AI agents for finance are redefining how financial institutions operate, improving efficiency, security, and customer experience. From investment management to fraud detection and customer support, AI agents have proven indispensable across various financial functions. As technology continues to evolve, the role of AI agents in finance is expected to expand further, paving the way for a more accessible, secure, and data-driven financial industry.

Leave a comment