Introduction

The role of AI agents in risk management has become increasingly prominent as organizations seek advanced tools to navigate complexities and uncertainties. These intelligent systems provide data-driven insights, enabling proactive strategies to identify, assess, and mitigate risks effectively. By streamlining decision-making processes, AI agents in risk management are transforming the traditional approaches that businesses rely on.

What Are AI Agents in Risk Management?

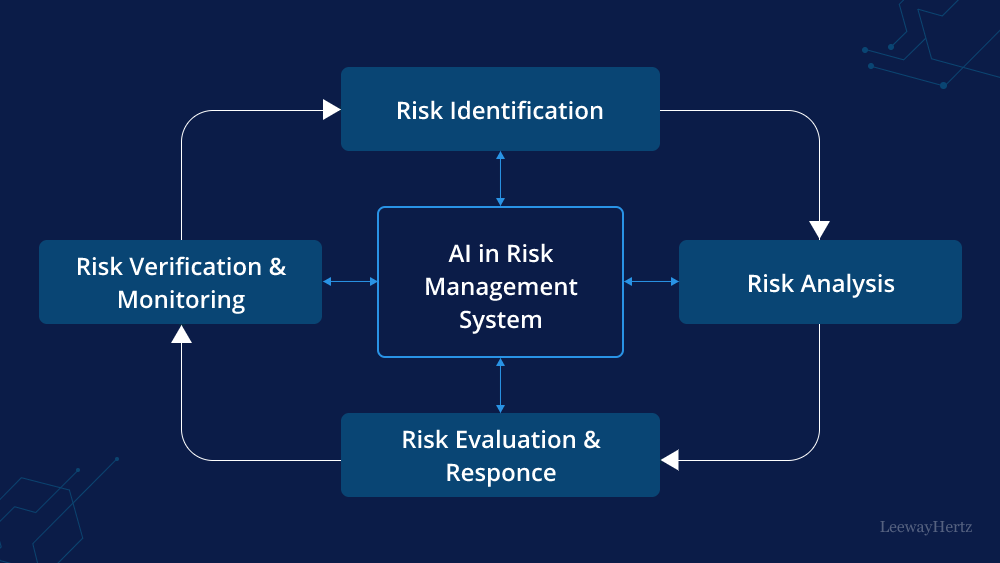

AI agents in risk management are sophisticated systems designed to analyze large volumes of data, identify potential risks, and recommend actionable solutions. They use machine learning algorithms, natural language processing, and predictive analytics to process structured and unstructured data.

Key functions of AI agents in risk management include:

- Risk identification through real-time monitoring of patterns.

- Assessment of potential impacts on operations and strategy.

- Automated generation of reports for better decision-making.

These agents are particularly valuable in industries like finance, healthcare, and manufacturing, where the stakes of poor risk management are high.

Benefits of AI Agents in Risk Management

- Enhanced Predictive Capabilities

Traditional risk management often relies on historical data and human intuition. However, AI agents in risk management leverage predictive analytics to forecast potential risks. This enables organizations to prepare for various scenarios, reducing surprises and mitigating losses. - Improved Efficiency

Manual risk analysis can be time-consuming and prone to errors. With AI agents in risk management, data processing is automated, allowing teams to focus on strategic decisions rather than administrative tasks. - Real-Time Risk Monitoring

Modern business environments are dynamic, with risks evolving rapidly. AI agents in risk management monitor data streams in real-time, ensuring organizations respond swiftly to emerging threats. - Cost Reduction

By preventing financial losses through early detection of risks, AI agents in risk management contribute to significant cost savings. Additionally, they reduce operational expenses by automating risk assessment processes. - Enhanced Compliance and Governance

Regulatory compliance is a critical aspect of risk management. AI agents in risk management help organizations adhere to regulations by identifying potential compliance risks and providing solutions to address them.

Key Applications of AI Agents in Risk Management

- Financial Risk Analysis

In finance, AI agents in risk management analyze market trends, credit risks, and fraud patterns. They assess portfolios and predict potential economic downturns, allowing businesses to adjust their strategies accordingly. - Operational Risk Management

Manufacturing and logistics benefit from AI agents in risk management by identifying supply chain disruptions and operational inefficiencies. These systems enhance resilience and ensure continuity. - Cybersecurity

AI agents play a pivotal role in identifying vulnerabilities and preventing cyberattacks. By analyzing network traffic, detecting anomalies, and implementing automated responses, they fortify an organization’s digital defenses. - Healthcare Risk Mitigation

Healthcare providers use AI agents in risk management to predict patient outcomes, reduce medical errors, and ensure compliance with safety protocols. These tools enhance patient care and operational efficiency.

How AI Agents in Risk Management Are Shaping the Future

As the technology behind AI agents in risk management evolves, their capabilities will expand further:

- Integration with IoT: The Internet of Things (IoT) generates vast amounts of data, which can be leveraged by AI agents in risk management to provide even more precise insights.

- Advanced Natural Language Processing: Improved language models will enable these agents to interpret complex regulatory documents and offer tailored compliance solutions.

- Ethical Risk Assessment: As societal expectations grow, AI agents in risk management will address ethical considerations, ensuring businesses operate responsibly.

- Self-Learning Systems: Machine learning advancements will allow AI agents in risk management to become more autonomous, adapting to new risks without human intervention.

Challenges and Considerations

While the benefits are substantial, organizations must address challenges when adopting AI agents in risk management:

- Data Quality: Poor-quality data can lead to inaccurate risk assessments. Organizations must ensure data integrity for effective use of AI systems.

- Bias in Algorithms: AI models can inherit biases from training data, leading to skewed risk evaluations. Regular auditing of algorithms is essential.

- Cost of Implementation: Deploying AI agents in risk management can be expensive initially, though the long-term benefits often outweigh the costs.

- Regulatory Uncertainty: As AI technologies evolve, regulatory frameworks may lag, creating uncertainties in compliance.

Conclusion

The integration of AI agents in risk management marks a significant advancement in how organizations address uncertainties. By offering predictive insights, real-time monitoring, and automated solutions, these systems empower businesses to act proactively and efficiently. As technology continues to evolve, AI agents in risk management will play an even more crucial role in shaping resilient and agile organizations.

Leave a comment